Financial Aid and Scholarships

Deciding to attend a Catholic college or university is deciding to make an important investment in your future. Like any long-term investment, it is important to research the value of Catholic education while discovering ways to make your investment more cost efficient. Take the time to understand financial aid because, although financial support is available through the institution and state and federal government, the responsibility for paying for college rests with the student and/or family.

National CCAA Scholarships

The National CCAA offers two different scholarships annually: The National CCAA First-Year Scholarship for incoming college-bound high school seniors attending one of the National CCAA member institutions in the fall, and The National CCAA Transfer Scholarship for transfer students from two-year colleges or universities attending a National CCAA member institution in the fall.

Many of the National CCAA member institutions offer scholarships for incoming and continuing students attending their institutions. Visit their websites to learn more about scholarship opportunities through these institutions.

THE NATIONAL CCAA FIRST-YEAR SCHOLARSHIP

THE NATIONAL CCAA TRANSFER SCHOLARSHIP

Where to Start

The college financial aid office is the best source of information about the types of aid available, including aid through the federal government and your state government. Talk to the college about financial aid early in your senior year of high school. Federal and state governments, colleges, and private organizations all sponsor student aid programs. Contact each institution you’re considering to determine the types of financial aid available and the average cost of attendance. Throughout the process, continue to improve your financial literacy, specifically when it comes to paying for higher education.

Questions to ask the financial aid office (PDF) >>

Learn the language of financial aid (PDF) >>

Federal and State Aid

Nearly 70% of student aid awarded each year comes from U.S. Department of Education programs, and states sponsor both need-based and non-need-based programs.

Free Application for Federal Student Aid (FAFSA)

Many colleges use the Free Application for Federal Student Aid (FAFSA) to determine your eligibility for college-based financial aid. Complete the FAFSA online, filing as early as October 1 in the year prior to entering college; deadlines to complete the FAFSA vary by institution. To obtain federal student aid, you must complete the FAFSA, and many colleges use the FAFSA to award aid in their own need-based programs. Complete the FAFSA each year you intend to receive aid. Submit a separate FAFSA for each student in the family who is attending college.

Note: Some also use the CSS PROFILE application, sponsored by the College Scholarship Service, to determine institutional aid. Check with the colleges of your choice to see which of these forms you must complete.

Determining Your Financial Need

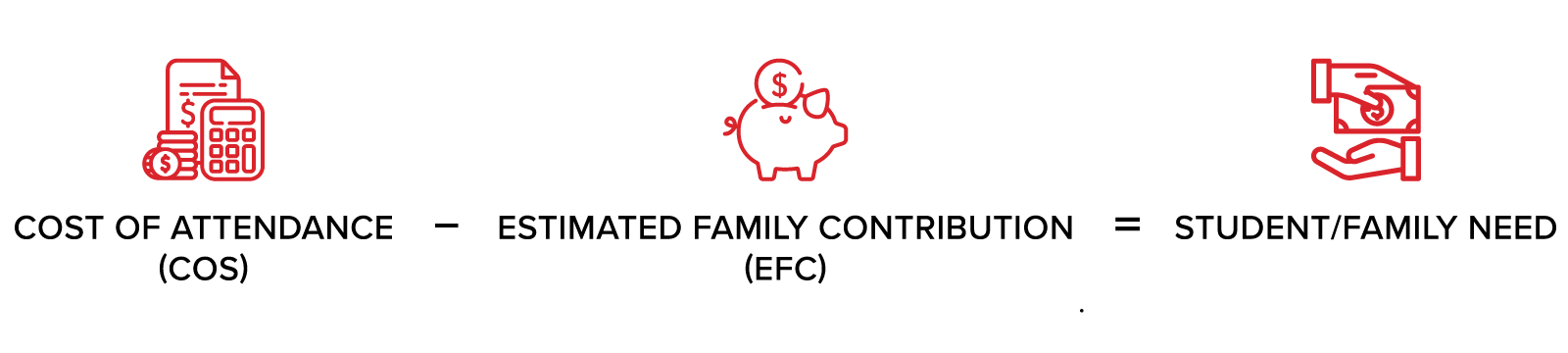

Colleges use the FAFSA (or CSS) to come up with your estimated family contribution (EFC). For the FAFSA, the EFC is determined by a formula that takes into account parent income, student income, parent assets, and student assets. Subtracting the EFC from the total cost of college (tuition and fees and, if applicable, room and board) often leaves a student with a remaining amount that needs to be covered.

This remaining amount can sometimes be partially or fully covered by scholarships and need-based aid, like grants, loans and work-study programs. Students should also conduct their own search for additional scholarships and financial aid. Although schools will work to offer the best financial aid package they can, it is ultimately the responsibility of the students and/or family to cover the costs associated with attending a college or university.

Scholarships and Grants

Scholarships and grants are awarded by universities and colleges, but may also be available from other sources, like:

- foundations

- religious organizations

- community organizations

- civic groups

- your parents' employers

College financial aid officers, high school guidance offices, or your public library are the best sources for information about aid of this type.

Criteria for receiving scholarships or grants — oftentimes based on academic, athletic, artistic, or other abilities — vary by institution. Check with universities or colleges for their application process and deadlines. Athletic scholarships often have strict policies associated with them, and tryouts or portfolios are typically required as part of an application for any artistic scholarships.

*Do not pay for a service that will help you find free money for college. Your high school may provide a free scholarship search service, and there are plenty of free services available on the Internet. These services usually provide a list of sources of private and other financial aid; contact these organizations to request their applications.